Wanting to get control of your finances is great, but there is nothing like the empowering feeling of knowing when this MAJOR life goal could actually be attainable. After examining my debts, pay off amounts, and interest rates, I am proud to announce that my magic number is 8 years and 3 months to be debt free! Having an end date for a goal helps to make it more tangible and keeps me encouraged to hit my payment milestones from my personalized Financial Plan.

Wanting to get control of your finances is great, but there is nothing like the empowering feeling of knowing when this MAJOR life goal could actually be attainable. After examining my debts, pay off amounts, and interest rates, I am proud to announce that my magic number is 8 years and 3 months to be debt free! Having an end date for a goal helps to make it more tangible and keeps me encouraged to hit my payment milestones from my personalized Financial Plan.

One Year from Now- Operation Credit Card

In January of this year, I revealed that I racked up $5300.00 in credit card debt, after getting it down to a zero balance. It happened by not adapting my spending habits to my drop in income. Today, that balance is now around $3400.00 by paying a little more every month on the minimum and doing the 52 Week Money Challenge (Bingo Style). Dare I say it out loud, I will have NO credit card debt by this time next year (insert fireworks here)! I’m truly proud of the way I have tackled this particular debt obstacle because I’m doing it at my own speed. I don’t even miss the extra money that I’m using to knock the balance down faster. If I were okay with just paying the minimum, it would take me 4 years and 3 months, instead of one year, to complete step one of my financial plan. Once the credit card is paid off, my monthly credit card payments will become extra payments to my student loans and so on…this is called the Snowball Method.

Four and a Half Years from Now- Goodbye Sallie Mae

I have a love/hate relationship with Sallie Mae. Although we go back about ten years, she is not my friend nor is she yours. Don’t let her fool you. Yes, in times of financial need, she was there but in reality most people end up paying more than double for their educational loans. Currently, I pay the minimum $200 per month for my educational loans with more money being applied toward interest and not the principal. As I’m sure you know, paying just the minimum and nothing more will result in years and years of interest and a longer pay off timeline. In fact, by adding the money I would normally use for Operation Credit Card to make two or three lump sum payments per year toward the principle, not interest, I will shorten the length of my loan by 10 years and 11 months. Five years ago, I was a recent college graduate and while a lot has happened in that time, I still feel like time flew by. Knowing that these next five years could go by just as quickly helps keep me motivated. One day, four and a half years from today, I will be able to say goodbye to my financial frienemy- Sallie Mae for good.

I have a love/hate relationship with Sallie Mae. Although we go back about ten years, she is not my friend nor is she yours. Don’t let her fool you. Yes, in times of financial need, she was there but in reality most people end up paying more than double for their educational loans. Currently, I pay the minimum $200 per month for my educational loans with more money being applied toward interest and not the principal. As I’m sure you know, paying just the minimum and nothing more will result in years and years of interest and a longer pay off timeline. In fact, by adding the money I would normally use for Operation Credit Card to make two or three lump sum payments per year toward the principle, not interest, I will shorten the length of my loan by 10 years and 11 months. Five years ago, I was a recent college graduate and while a lot has happened in that time, I still feel like time flew by. Knowing that these next five years could go by just as quickly helps keep me motivated. One day, four and a half years from today, I will be able to say goodbye to my financial frienemy- Sallie Mae for good.

Eight Years and Three Months- Debt Free

A lot can happen in eight plus years that could slow down my timeline or cause me to come up with a new goal altogether. Regardless of what life throws my way, I hope a victorious sprint toward financial freedom is in my foreseeable future. In eight years, my home will be a rental property providing is a great form of passive income. Having it completely paid off allows a greater financial contribution to my household. The idea of never having to think about another mortgage payment for my current house is a blessing in itself and I plan on tackling this debt by using the Snowball Method. In the same breath that I say goodbye to Sallie Mae, I will be begin this last phase by saying hello to extra payments, consisting of my monthly credit card payments and Sallie Mae payments, on top of my current mortgage.

What’s the point of all of this? Sure, I could continue to pay the minimum on my bills every month and I will forever owe someone but I have 17,636 reasons why that won’t work for me. Yep, having a plan and attacking my plan will help me save an overall of $17,635.15 in interest payments. While yes, I am at the beginning of my journey, I take solace in knowing there is light at the end of the tunnel.

How Long Will It Take You to Be Debt Free?

FACEBOOK, TWITTER, PINTEREST, RSS Feed,

Email SMC: shemakescents@gmail.com

Abi Ferrin is a fashion designer, humanitarian, a woman who uses her “cents” to ignite awareness in global issues and define what that success means to her… oh and did I mention that she is our November Woman to Watch (#w2w). She defines success as “a moving target”, explains Ferrin in an email interview with She Makes Cents. ABI FERRIN, the company, is the versatile and sophisticated fashion brand that offers easy-to-care-for fabrics providing a chic solution for women of all ages and body types; remember the

Abi Ferrin is a fashion designer, humanitarian, a woman who uses her “cents” to ignite awareness in global issues and define what that success means to her… oh and did I mention that she is our November Woman to Watch (#w2w). She defines success as “a moving target”, explains Ferrin in an email interview with She Makes Cents. ABI FERRIN, the company, is the versatile and sophisticated fashion brand that offers easy-to-care-for fabrics providing a chic solution for women of all ages and body types; remember the

Everyone has a different tipping policy, which was clear from the vibrant discussion on the

Everyone has a different tipping policy, which was clear from the vibrant discussion on the

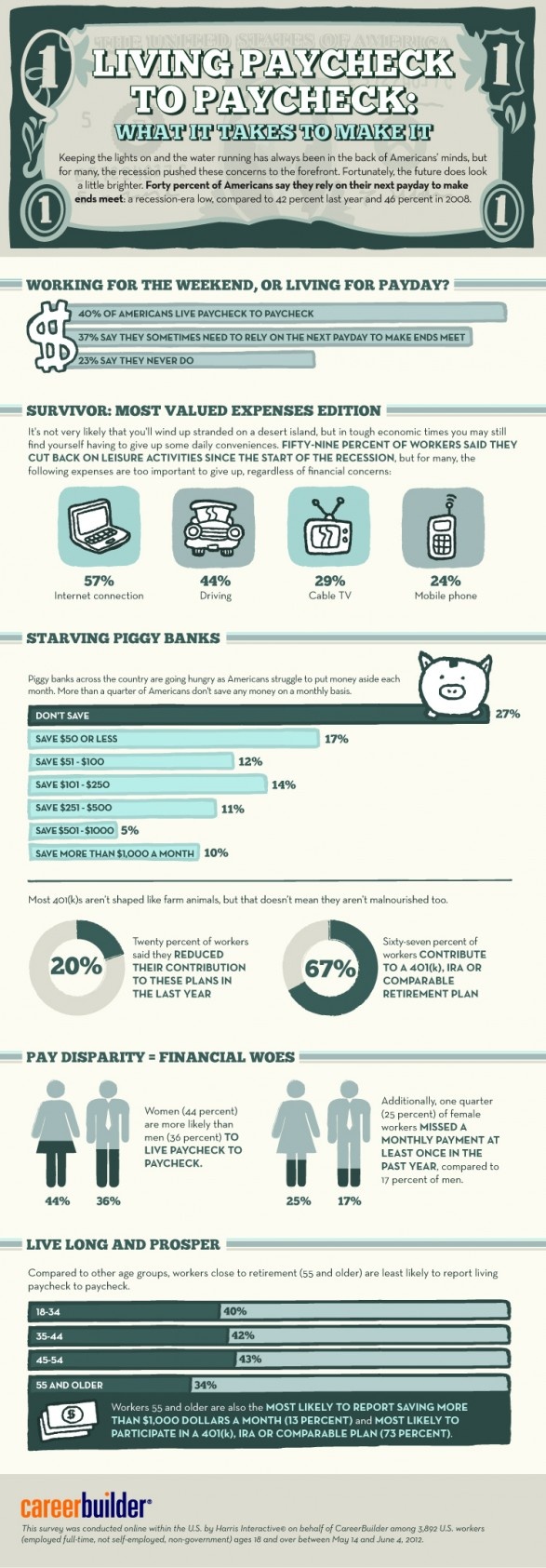

It’s the weekend baby (or close enough) and for some of you that also means PAYDAY! A joyous day that, in theory, represents the culmination of your hard work. Regardless of your income, this is the day when you get the funds to take care of all the things in your life that need funding. So what happens when you get paid and you are already broke? Not broke, as in oh I have a hundred-dollar bill in the back pocket of that pair of skinny jeans, but more like, how I am going to afford the gas to get to work and eat once I’m there? For some of you this is a baffling predicament to be in and for others, this may very well be your reality. I know a woman, Carrie*, who just got paid today and is already broke. Having past due bills is her norm, she is struggling to stay afloat, and her zero balance checking account doesn’t help. From talking to her, I gathered that she is overwhelmed with her situation, feels alone, and wonders how something that is supposed to represent the culmination of your hard work is worth nothing.

It’s the weekend baby (or close enough) and for some of you that also means PAYDAY! A joyous day that, in theory, represents the culmination of your hard work. Regardless of your income, this is the day when you get the funds to take care of all the things in your life that need funding. So what happens when you get paid and you are already broke? Not broke, as in oh I have a hundred-dollar bill in the back pocket of that pair of skinny jeans, but more like, how I am going to afford the gas to get to work and eat once I’m there? For some of you this is a baffling predicament to be in and for others, this may very well be your reality. I know a woman, Carrie*, who just got paid today and is already broke. Having past due bills is her norm, she is struggling to stay afloat, and her zero balance checking account doesn’t help. From talking to her, I gathered that she is overwhelmed with her situation, feels alone, and wonders how something that is supposed to represent the culmination of your hard work is worth nothing.