Hey, fabulous readers of She Makes Cents! We have some exciting news to share with you all. We are thrilled to announce that She Makes Cents, by Danielle YB Vason, has been recognized as one… More

ecoATM: A Sustainable Way to Earn Instant Cash for Old Smartphones

This is a sponsored post…meaning mutually beneficial. You get access to information about a brand or product that I’m confident you will LOVE (at no cost to you) and I get compensated to tell you about it (which keeps She Makes Cents going strong)! For more information, check out the SMC disclosure policy.

I’ll admit, I’m a little out of practice when it comes to small talk (thank you maternity leave, and quarantine). Yet, when I found myself discussing my collection of unused cell phones in the middle of an Atlanta United MLS game, it wasn’t because of my out-of-practice social skills. Rather, it was an example of a meeting of the minds. The cool breeze from the retractable roof of Mercedes Benz Stadium, the sound of fan cheers for the home team, and the ambiance of the private suite created a perfect backdrop to enjoy meeting a curated and diverse group of guests of ecoATM, who invest in people, their communities, and the planet.

ecoATM is a global smartphone and mobile device trade-in leader who is the official smartphone trade-in partner of Atlanta United. During the final four home games of the season, one of which I was able to attend, fans were given the opportunity to donate used smartphones at designated stadium drop-off locations. ecoATM then donated 40% of revenues from smartphones dropped off by Atlanta United fans at Mercedes-Benz Stadium to Cell Phones For Soldiers, a national nonprofit 501(c)3 organization dedicated to providing cost-free communication services, devices, and emergency funding to active-duty military members and veterans. According to Chief Marketing Officer, Tony Rome, “Our partnership with Atlanta United and Cell Phones For Soldiers is a powerful way for fans to support our troops and move used devices from sitting in a drawer to powering new dreams. That’s sustainability in action.”

What makes ecoATM different from other trade-in options available is that they leverage technology to develop a safe and secure solution to help increase the recycling rate for electronic devices. While yes, there are other trade-in options on the market, some of which may even offer a higher payout, it is rare to find an option that gives you cash on the spot… hence the ATM part of their name.

Are you looking to clean out your junk drawer? Do you have a device so old that you are unable to trade it in with your mobile carrier? Is it important to you that your unused smartphone does not end up in a landfill? Could you use cash in your hand today? If you answered yes to any or all of these questions, you should consider ecoATM as a safe and reliable option.

Before heading to one of the thousands of ecoATM kiosks across the country, I recommend that you get a price estimate on their website or lock in your price offer on the ecoATM app. That way, you know upfront how much cashback you should expect for each device you sell. To get the actual price (and not an estimate), you will be asked to connect your phone to the kiosk so it can check the electronics while doing a visual evaluation. Once the evaluation is complete you will be offered a price. A popular and fully functional device will get a higher price than an older or damaged device but they also claim to pay the best prices they can for phones that are damaged or don’t work. You then have the choice to accept or reject the offer. If you accept the offer, you get paid…in CASH… on the spot. That sounds like a good way to add a little extra to one of your sinking funds, don’t you think?

Meeting the team from ecoATM was such an eye-opening experience because the concept aligns with money and environmental sustainability values that I already invest time and energy into. According to the Pew Research Center, 91% of American adults own a cell phone, 55% own a smartphone, but only 20% of unwanted cell phones are recycled each year. I am an avid recycler but I have never thought about how to responsibly get rid of unused devices. Some of my devices are so old that having the opportunity to sell or recycle in a way that doesn’t further contribute to eWaste inspires me to take a “don’t trash it, cash it” approach to my debilitated smartphone collection.

My Credit Score Dropped 47 Points & I’m Happy AF

When I first earned a spot in the 800 club people asked me questions about how to raise their credit score. The truth is, it isn’t a quick process but it can be an easy one if you understand how to play the credit score game. I was proud of myself because I felt like it was a reflection of my hard work. I would dare say, it gave me validation, experience, and a sense of purpose. My credit score continued to rise to 827 and then one day I opened an email with my updated credit score to see that it reached 847. 8-4-7!!! That’s right, I was only 3 points away from a PERFECT credit score and being that close made me lust for more.

For me, I found a perfect credit score to be sexy and I felt sexy for being so close to having one. Yet, I knew that my lust was for a fleeting goal so I lingered in the honeymoon stage of my 847 for as long as I could. It lasted for two months. I was not surprised one bit, though, because to understand why my score plummeted is to first understand how credit scores are calculated.

How Are Credit Scores Calculated?

Your credit score is a combination of debt history (35%), the amount owed (30%), length of credit history (15%), new debt (10%), and type of debt used (10%). I didn’t have a credit card in college so my debt history began 10+ years ago when I got two loans to cover my college tuition for a year. My student loans represented the longest payment history and second largest debt owed outside of my mortgage. That is to say, my 10 years of on-time payments and one year of deferment toward student loan debt represented the two highest percentages that are used to calculate one’s credit score.

As the length of the payment history increased, the amount owed on my student loans decreased, and my debt to credit ratio was swinging in my favor, it created a perfect storm of excellent creditworthiness as measured by my FICO score. Hint hint: THIS…is how you get into the 800 club. I was snowballing my student loan debt so that when faced with a future change to the income of our household, the Mr. and I decided to pay off the remaining $7K and be done with the debt once and for all. One would think that the lowering my debt to credit ratio by eliminating the student loan debt would be enough to increase my credit score the last 3 points, but the opposite was true. Paying off this debt completely had the biggest negative impact on my high credit score. I watched my credit score fall 37 points and then another 10 more. So lame.

Even so, I would rather have a debt paid in full and suffer the consequences of a lower credit score than to draw out a debt payoff to get a perfect FICO score. Yes, I found the idea of having a perfect credit score sexy, but there is nothing sexier than a PAID IN FULL student loan balance…except the Mr. in a 3 piece suit. They say happiness is the new rich and inner peace is the new success. By that description, my paid in full student loan debt and my new credit score makes me “rich”, “successful”, oh….and happy AF.

Here is an easier way to pay off your mortgage faster…

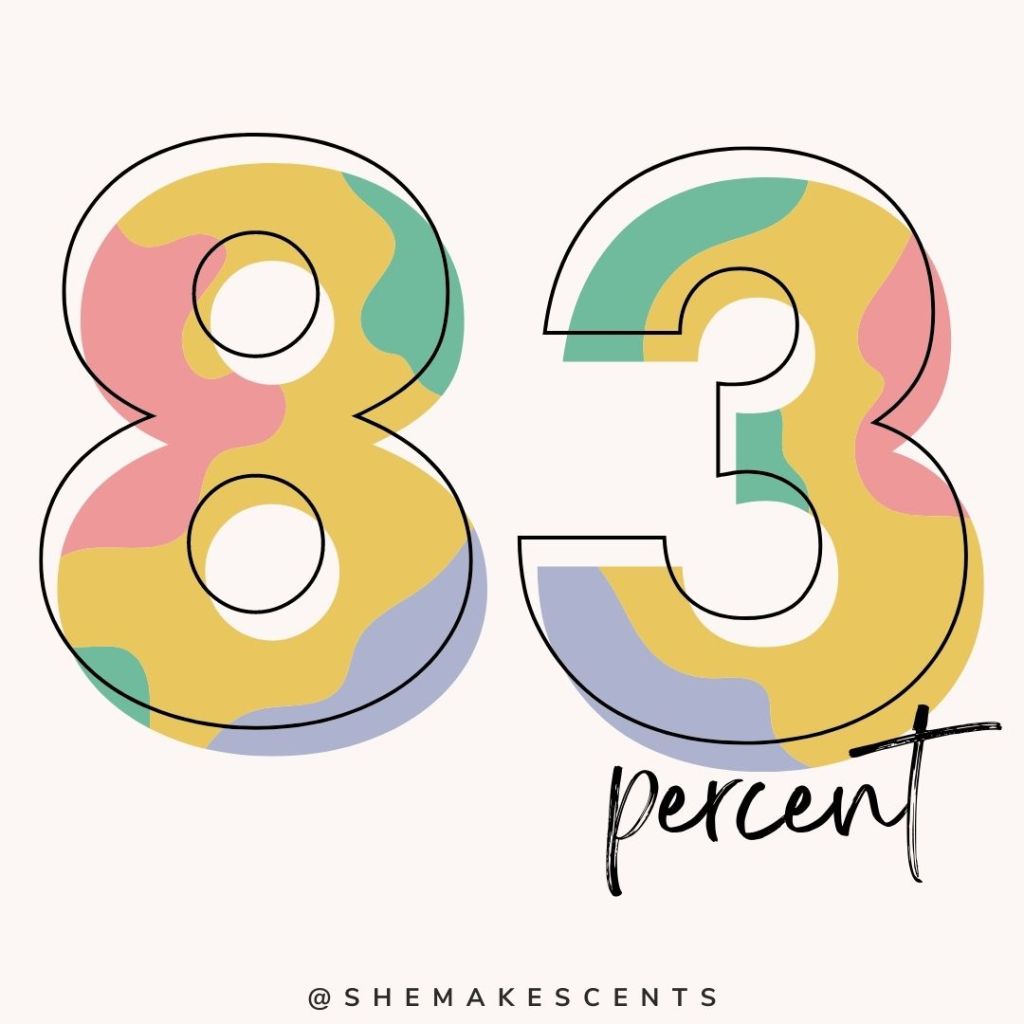

In 2020, 45% of my mortgage payment applied to interest, and the remaining 55% was applied to principal. However, in 2021, I turned that number around SIGNIFICANTLY to reflect 83% of my mortgage payment going toward the principal and only 18% going to interest.

2020: 45% interest/ 55% principal

2021: 17% interest/ 83% principal

…talk about making your money work for you!!!!

How do you ask?

I started making a few easy changes and you can too…

☆ Round Your Payments Up: Rounding up to the next highest $10 or $100 amount can significantly help reduce the term of your mortgage by putting those small amounts towards the principal.

☆ Make Biweekly Mortgage Payments: There are 52 weeks in a year and 26 biweekly periods. That is the same as making 13 regular monthly payments. As it turns out, that one extra payment per year can add up – a lot. Biweekly mortgage payments will allow you to make one full mortgage payment directly towards the principal. You will be reducing the amount of interest you will have to pay over the life of the loan.

☆ Set a goal for your mortgage: I knew at this time last year that I wanted the balance on my mortgage to be a certain amount by the end of the year. To accomplish this goal, anytime time I received “extra” money (i.e. tax returns or unexpected income) I always made sure a great portion went toward my yearly money goal. That is in addition to all of the money I saved doing the #SMCmoneychallenge, of course.

☆ Get to Know Your Amortization Schedule: I have never pulled up my mortgage amortization schedule more than I did this year. It was important to me to know the exact number/percent of my mortgage payment was being applied to my payment AND then make sure that any extra money I applied to the principal was always MORE than what was being applied to the interest.

Many people get caught up in waiting until they have saved a large lump sum before many any type of move towards their goals. I am proof that if you apply what you can afford, be it an extra $5, $500, or $5000 because even a small step is still a step in the right direction when it comes to goals.

How I Ditched My Private Mortgage Insurance (PMI)

When I purchased my first home 12 years ago, I had no idea what I was doing. I saw the house on a Tuesday, put an offer in on a Sunday, and the road to homeownership began 5 days after my 24th birthday. Because I wasn’t really planning on buying a house at that time, I didn’t have a sinking fund for a house down payment. I simply had my regular savings funded my money I earned in my first real job out of college. Oh, and did I mention that all of this happened in the middle of the recession?

For a little financial transparency on my homebuying process, I took out a 30 year FHA loan on a foreclosed home that needed many repairs and renovations. My loan was equal to the purchase price, plus a little extra for repairs, minus my less than 20% down payment.

Because I purchased a home with less than 20% of the home’s purchase price, I was required by my lender to pay private mortgage insurance (PMI) as a condition of my mortgage loan. According to article 5 Types of Mortgage PMI, “when a borrower makes a down payment of less than 20% of the property’s value, the mortgage’s loan-to-value (LTV) ratio is over 80% (the higher the LTV ratio, the higher the risk profile of the mortgage for the lender)”. PMI was create to protect lenders in case higher risk homeowners default on the loan. While it sucks to pay extra PMI on top of my monthly mortgage payment, this condition did allow me to become a homeowner even though I could afford the 20% at the time.

After 12 years of paying private mortgage insurance, I called my lender today to get it cancelled. I did not need a script that some people try to sell online. I simply called on a whim and asked to cancel my PMI. To be honest, I was not expecting it to be cancelled but rather I was expecting them to tell me I had to get to a certain balance to qualify. I personally believe what helped sway the decision was the fact the value in my home, like many other homes in the US right now. Since the equity value increased it lowered my mortgage’s loan-to-value (LTV) ration and I am now able to save a little more each month on the mortgage.

Other Ways to Avoid PMI

Save 20% Before You Buy a House. It is easy for people in the personal finance community to dish out this piece of advice to potential homebuyers but depending on the circumstances, saving 20% on a home price can be difficult. The Statista Research Department explains that “after plateauing between 2017 and 2019, house prices in the United States saw an increase in 2020 and 2021. The average sales price of a new home in 2020 was 389,400 U.S. dollars and in 2021, it reached 408,800 U.S. dollars”. To purchase a house for $408,800 with you 20% down payment, you would need have $81,760 in liquid funds available.

Are You A Veteran or Active Military? One of the many benefits of a VA loan is that you are not required to pay PMI. This is beneficial because you can buy a home now without having to first save for a down payment.

Getting a Small Loan to Cover the Down Payment A homebuyer may be able to avoid PMI by piggybacking a smaller loan to cover the down payment on top of the primary mortgage. I personally wouldn’t recommend this option, but again, others in the personal finance community do.

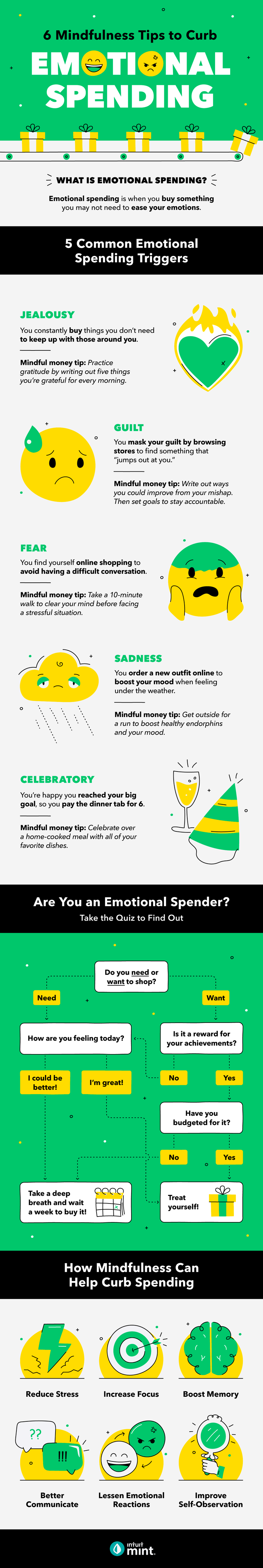

Are You an Emotional Spender?

Emotional spending is when you buy things you don’t need to mask or dull emotions or with the hope that the purchase will make you feel happier. While spending can make you feel happier in the moment, you are often left with a spending hangover. Emotional spending can get the best of us, especially during after a year full of ups and downs. Mint, provided a wonderful visual breaks down what emotional spending is, the different emotional spending trigger types, and how to counteract each type of emotional spending.

Check it out!

The Ultimate Guide to Making Your Money Goals S.M.A.R.T.E.R

When it comes to goal-setting, the S.M.A.R.T. goal system reigns supreme in its methodology. According to this approach, goals should be specific, measurable, attainable, realistic, and timely. To make them S.M.A.R.T.E.R., goals must also be able to be evaluated and rewarded or readjusted.

This year, the hubby and I made the joint decision to focus our financial efforts on making a dent in the balance on his car. In theory, this is a good goal but because it’s vague AF without a clear timeline, among other things, it’s not a S.M.A.R.T. goal. So back to the drawing board we went.

How To Make Your Goals More Specific

Ask yourself these questions: What do you want to achieve? Why do you want to achieve it? Who needs to be on board for this goal to be successful? If your written goal doesn’t address these questions, then revise.

We needed to improve our goal because we didn’t clarify what a “dent” represented numerically. Was a dent $1,000.00, $5,000.00, $10,000 or more? I realized quickly that we were not on the same page. Making a dent in the remaining balance for his car became a more specific goal once we decided we wanted to get our balance down from $17,601.01 to $5,000.00 or less by the last day of this year. To be successful at this money goal, my hubby and I would need to combine forces because our “dent” represented a $12,601.00 reduction. This goal is important to us because the sooner this debt is eliminated, the sooner we will be debt-free (not including mortgages), we can move on to Dave Ramsey’s Baby Step 3, and focus on increasing our savings and sinking fund contributions.

Giving this goal a deadline of the last day of the year OR a balance of $5,000.00, whichever comes first, makes it measurable and timely. It checks off both prerequisites because it identifies how and when we would consider this goal accomplished.

Are Your Goals Realistic & Attainable?

Setting unrealistic goals is a set up for failure and defeat- both of which can kill your spirit and drive to pursue future goals. This is why if you follow Dave Ramsey’s Baby Steps the first step is to save only $1,000 because the gratification of reaching your first goal inspires you to move on to the second.

Setting goals that are too easy can also be a set up for failure because an easy goal requires lower expelled energy and effort, which lowers motivation. Finding the right balance is like Goldielock’s breaking and entering to find the perfect porridge. Your goal has to be just right…

In her book, Boss Women Pray, by Kachelle Kelly, she asserts that “a goal can be both lofty and practical”. When I read that, I immediately thought about how the idea of paying off my student loans was a lofty goal but also attainable. The success in that was breaking the BIG GOAL down into smaller goals with specific benchmarks until the BIG GOAL no longer seemed so…well, big.

For the case of our $12,601.00 goal, it is a bit lofty in the sense that it requires us to expel higher energy, intention, discipline, and sacrifice for it to be achievable. Once we set down and figured out how much we could afford to put into this goal right away and then figured out how much we would need to save per quarter to stay on track, our joint goal also became practical. I even went so far as to break the goal down on a micro level to see how much we would need to save per month and per week to stay on track. Seeing those numbers and that information all at once, made the goal that could seem too lofty become feasible with the right amount of effort and action.

Even though paying off $12,601 on the car loan doesn’t eliminate the debt completely, it is relevant because it does link to the larger objective of ultimately paying the car off in full. Once we reach our goal this year, we will only be $5,000.00 away from a debt free life (not including mortgages).

Going the Extra Step from S.M.A.R.T. Goals to S.M.A.R.T.E.R. Goals

The difference between the S.M.A.R.T. and S.M.A.R.T.E.R. goals acronym is the “E” and the “R”, which represents evaluated and rewarded or readjusted. In your goal-setting journey, it is imperative that you evaluate your goals on a regular basis to make sure you are on track. This is why the #SMCmoneytribe check-ins occur weekly (join the SMC Money Tribe on Facebook). If you find yourself off track and constantly dodging obstacles, then it is time to revisit the goal, tweak where it is necessary, and get back on the goal-setting journey. If, however, your regular check-ins reveal that you are on track for the timeline for your goal execution, take a moment and celebrate that! Taking the time to acknowledge where you started versus how it’s going, not only honors your hard work, but it may also inspire someone else in the process.

GRAB YOUR S.M.A.R.T.E.R. MONEY GOALS PRINTABLE?

Often women are left to fend for themselves with regards to money matters. As an active member of the #SMCmoneytribe, you will no longer have to walk the path toward financial freedom and a fabulous lifestyle alone. Should you get off track, you can always catch up or start over, we just ask that you don’t give up on this challenge, your goals, or yourself. YOU can do it and you have an entire TRIBE of people cheering you on.

5 Things You Should Do Before Starting the SMC Money Challenge

It is important to challenge yourself every now and then. This helps you push beyond what you have previously done before. The more you challenge yourself and succeed, the greater your confidence in your ability to do it again next time. Good habits form and eventually they become lifestyle changes. When you accept a financial challenge, like the SMC Money Challenge, it doesn’t just help you grow your skills and knowledge, it helps you grow your belief that you can. The 2021 SMC Money Challenge begins January 1st in the #SMCmoneytribe FB group but before you start, here are some of my favorite ways I kickstart my money goals at the beginning of each year.

the beginner’s guide to hacking a money challenge

- Download & Print your money tracker for the year. Sometimes it is easy to forget the progress you are making. In the SMC Money Challenge, there will be weeks where the progress seems minuscule and other times where the progression of better money habits and actions is obvious. Using the tracker will help remind you at the end of the 52 weeks just how far you’ve come.

- Pick a S.M.A.R.T.E.R money goal. Are you paying off debt, saving for a rainy day, putting money in a sinking fund for a specific purchase, or investing? Now is the time to make sure your goal(s) is clear and attainable. Is it specific, measurable, achievable, relevant, time-bound, evaluate, and reviewed?

- Tell Your Money Where to Go. If you are using the challenge to pay off debt, I recommend that you make a principal payment toward your debt instead of putting that money in a savings account or sinking fund (that is one of my easiest tricks for paying off my student loans 11 years ahead of schedule). However, if you are using the money you save in this challenge for sinking funds or boosting your emergency fund, I would consider opening a high-yield savings account and transferring your challenge money into it each week instead.

- Set a Reminder. Add a reminder to your phone or calendar to remind you to check-in. By saving something every week, you get to practice your savings habit over and over again. Remember, it can take anywhere from 18 to 254 days for a person to form a new habit and an average of 66 days for a new behavior to become automatic. YOU WILL NEED A REMINDER if you want to make it through ALL 52 weeks.

- Invite a Friend. There is nothing better than getting support and supporting people you know, IRL (in real life). Iron sharpens iron. Glow up together with your friends to become real #squadgoals.

ARE YOU READY TO JUMPSTART YOUR MONEY GOALS?

Often women are left to fend for themselves with regards to money matters. As an active member of the #SMCmoneytribe, you will no longer have to walk the path toward financial freedom and a fabulous lifestyle alone. Should you get off track, you can always catch up or start over, we just ask that you don’t give up on this challenge, your goals, or yourself. YOU can do it and you have an entire TRIBE of people cheering you on!

How To Jumpstart Your Money Goals with the SMC Money Saving Challenge

Hey there, goal-setter! I see YOU. You are looking toward the new year and you are ready to make some changes. You recognize what worked for you financially and what didn’t this past year and you are finally ready to do something your future self will thank you for.

If this sounds like you, keep reading because the SMC Money Challenge may be just what you need…

WHAT IS THE 52 WEEK SMC MONEY CHALLENGE?

The SMC Money Challenge is back for its SEVENTH year! This challenge is a weekly savings plan that works for everyone, no matter one’s level of financial literacy or income. Hint Hint: accept the challenge, your future self (one year from now) will thank you! Every week you will cross off a number between 1-52 and apply that amount toward your money goal(s). Bonus boxes are also available for those looking to push themselves to save even more. SMC Money Tribe member, Cari, took advantage of the SMC Money Challenge bonus boxes on her money tracker and saved $15,000.00 in last year’s challenge. In the past three years, SMC Money Tribe leader, Danielle YB Vason and her husband used this challenge to pay off $44,000.00 in debt. Now, imagine what your money success story will be.

WHO IS THE SMC MONEY TRIBE?

The SMC Money Tribe is a community of goal-setting women who accepted the challenge to invest in their money and lifestyle goals with the best accountability partners out there- other women who are also shifting mindsets while tackling debt, saving money, and replacing bad money habits with smart money moves.

Those who accept the challenge are most successful when they also join the SMC Money Tribe Facebook group for weekly check-ins to share their progress, ask questions, and cheer each other on. By saving something every week, you get to practice your saving habit over and over until it becomes a lifestyle. Remember, personal finance is 80% behavior and 20% knowledge.

SMC Money Tribe member, Cari, took advantage of the SMC Money Challenge bonus boxes on her money tracker and saved $15,000.00 in last year’s challenge.

WHEN DOES THE CHALLENGE BEGIN?

Mark your calendars, the SMC Money Challenge begins Friday, January 1, 2021. After that, weekly check-ins will open up every Thursday at 11:00am (EST) and will stay open until Friday night on the SMC Facebook Group. During that time, SMC Money Tribe members are expected to invest in their goals by actively participating in weekly progress updates, money chats, and mini-challenges. Interactive content related to the challenge will also be available on the @shemakescents Instagram page.

HOW TO JOIN THE 2021 SMC MONEY CHALLENGE

- Follow @shemakescents on Instagram

- Post this image below in your Instagram Story (you MUST tag @shemakescents to I can see it).

- Join the SMC Facebook Group (this will be your home base for the tribe to ask questions, support each other, and hold each other accountable).

- Download your 2021 SMC Money Challenge Guides- Instagram version or Print version (Challenge Hack: Use the Instagram version to share your progress with the tribe & print the main version to add more private information to track your more personal goals at home).

- Set a calendar weekly to save your money & check-in

ARE YOU READY TO JUMPSTART YOUR MONEY GOALS?

Often women are left to fend for themselves with regards to money matters. As an active member of the #SMCmoneytribe, you will no longer have to walk the path toward financial freedom and a fabulous lifestyle alone. Should you get off track, you can always catch up or start over, we just ask that you don’t give up on this challenge, your goals, or yourself. YOU can do it and you have an entire TRIBE of people cheering you on!

HOW TO SELECT THE PERFECT POWER WORD OF THE YEAR

Oh…My….Goodness. We did it. We survived 2020 (assuming we make it the next few days) and that is not to be taken lightly. So now that you survived let’s get 2021 in order. If you are a long time follower of She Makes Cents, you know that we start every new year with a power word/ word of the year to help set our intention. So let’s get started.

HOW TO SELECT THE PERFECT POWER WORD OF THE YEAR

When choosing a word of the year it is important to select a word that is both inspirational and aspirational. Power words are often verbs because they require action on your part to fully integrate them into your life. That’s right, it is time to be intentional with our actions. Ask yourself, what doesn’t feel like [your power word] in your life right now? Think about how you could apply your word to your goals for yourself. For example, the team from Dave Ramsey.com shares 7 areas in your life for S.M.A.R.T. goals. The goal categories are financial goals, spiritual goals, educational goals, career goals, family goals, fitness goals, and social goals. Does your word of the year apply to any, if not all, of the S.M.A.R.T. goal categories? If so, keep reading.

WHY POWER WORDS ARE EFFECTIVE

A power word is like a New Year’s resolution but so much better. When used correctly, it guides the intentions and goals that one sets for oneself. Since 2013, I have asked She Makes Cents readers to share one word to reflect their personal goals/resolutions/vision for the year ahead and the response every year is inspiring. I love doing this because with every 365 days that go by, we evolve and our needs, wants, and aspirations change. I am not the same person I was at the beginning of 2020 and my mental, physical, financial, and emotional evolution this year has inspired my power word for 2021.

Unlike in previous years, my 2021 power word works for every aspect of my life: financial, personal development, career, lifestyle, and quarantine life.

Looking back at my earlier power words, I remember where I was in my life, what was important, and what I needed to work on. In 2013 my word was balance. Then came focus (2014), passion (2015), bravery (2016), intention (2017), declutter (2018), bloom (2019) – fun fact, my daughter was born in 2019 and her name, Chloe, means “to bloom” – and discipline (2020). This year, I am very proud to share that my word of the year is SIMPLIFY.

By definition, simplify is a verb that means to make [something] less complex or complicated; make plainer or easier. For the year 2021, I challenge myself to simplify my financial goals, family goals, fitness goals, personal development goals, and every other area of my life. I am looking forward to uncomplicating my life, goals, and actions and I look forward to seeing how much has changed one year from now.

I would love to hear your POWER Word of the Year. Please share your 2021 Word of the Year in the comments below, or hop over to the SMC Instagram to share your word there!

How I Reached My 2020 Money Goal Despite A Financial Pandemic

At the beginning of 2020, I set a goal to get my mortgage balance on our rental property under $40,000. I wrote the goal down on a post-it, shared it in the #SMCMoneyTribe group on Facebook, and dedicated one month of my SMC Money Challenge savings toward a large principal payment on my mortgage. Four weeks later, the Coronavirus pandemic hit followed by a financial pandemic and I forgot all about my BIG GOAL. At that point in 2020, my focus was trying to find toilet paper and make sure my family was fed.

I started the year with “discipline” as my power word but “pivoting” became more appropriate. I had to pivot when some of my income sources became unreliable and my 2020 money goal got further and further out of focus. Then one day, after months of quarantining, I found my little post-it displaying my BIG GOAL. I took a moment and thought about how it would feel to have my mortgage look like most people’s new car payment. I thought about the long term money goals that my husband and I have for our family of three (plus 2 fur babies). Then…I thought about what it would feel like if it was paid off completely. Could I reach my goal by getting my mortgage under $40,000.00 this year? I wasn’t sure, but I sure as hell was going to try.

Since I wasn’t planning on traveling anytime soon due to the Coronavirus, I pivoted and used my travel sinking fund to make a principal payment in addition to the monthly mortgage & escrow payments. Then anytime I had extra money from a sinking fund, I would send another payment. One principle payment was as low as $15.00 but I didn’t care because that meant I was $15.00 closer to my goal. On December 11, 2020, I sent my last principal payment of $80.00 and with that payment, I hit my BIG MONEY GOAL for 2020. My current mortgage balance is $39,977.20. I am so proud of myself and I can’t wait to see what 2021 brings.

I walked into 2020 with excitement and hope. I plan to leave it with excitement that I survived and gratitude for both the big and small wins of this year.

WANT TO REACH YOUR 2021 GOALS?

Invest in your money and lifestyle goals with the #SMCMoneyTribe by following along. You will be informed, inspired, and empowered to use your “cents” to live the #fablife.

Why Yearly Power Words Are Important for Goal-Setters

A power word is like a New Year’s resolution but so much better. When used correctly, it guides the intentions and goals that one sets for oneself. Since 2013, I have asked She Makes Cents readers to share one word to reflect their personal goals/resolutions/vision for the year ahead and the response every year is inspiring. I love doing this because with every 365 days that go by, we evolve and our needs, wants, and aspirations change. Looking back at my earlier power words, I remember where I was in my life, what was important, and what I needed to work on. In 2013 my word was balance. Then came focus (2014), passion (2015), bravery (2016), intention (2017), declutter (2018) and bloom (2019). Fun fact, my daughter was born in 2019 and her name, Chloe, means “to bloom”.

My power word for 2020 is DISCIPLINED. By definition, being disciplined is being trained to develop through self-control. The word “disciplined” is one that I will apply to every area of my life in a mental, physical, and spiritual sense. I will take this year as an opportunity to take a disciplined approach to complete the money challenge, hitting my milestones for my long term goals, and setting time aside for self-care. I was inspired by this quote, “You will never ALWAYS be motivated, so you must learn to be DISCIPLINED”. Truth be told, it is easy to be great when you are energized and motivated. The true value of a disciplined mindset reveals itself when you are too tired to keep pushing, when temptation is in the midst, and when distractions are everywhere but you’re strict with your goals and prevail anyway.

My power word for 2020 is DISCIPLINED. By definition, being disciplined is being trained to develop through self-control. The word “disciplined” is one that I will apply to every area of my life in a mental, physical, and spiritual sense. I will take this year as an opportunity to take a disciplined approach to complete the money challenge, hitting my milestones for my long term goals, and setting time aside for self-care. I was inspired by this quote, “You will never ALWAYS be motivated, so you must learn to be DISCIPLINED”. Truth be told, it is easy to be great when you are energized and motivated. The true value of a disciplined mindset reveals itself when you are too tired to keep pushing, when temptation is in the midst, and when distractions are everywhere but you’re strict with your goals and prevail anyway.

I’m so excited to apply a power word to my year and this one is all-encompassing to several areas of my life. I know many people do not do resolutions anymore, but I still do. Now that I have my word of the year, I can clarify my money, career, and lifestyle goals.

Talk to me in the comments below, what one word to reflect their personal goals/resolutions/vision for the year ahead?

>

>