As we approach the end of week 33, I must say, staying on top of the 52 Week BINGO Challenge is taking a little more discipline, for me, than in past weeks. I had a goal to pay off my credit card by August 1st and I beat that goal by a month. How, you ask? Well, the closer I got to a zero balance on that debt, the more aggressive I became with this financial goal. As always, I paid more than the minimum balance and started dumping any and all unassigned money toward that goal. In working toward the big credit card payoff, I developed a solid habit of saving. Now that this first goal is done and the high of the gratification is dwindling down, it does look slightly daunting when I look at my next goal on the snowball– my student loans with it’s $18,593.25 balance. Ugh!! I plan on making quarterly payments towards the principle with the money that was previously allocated to my credit card minimum + the 52 Week BINGO Challenge to shave off years of interest and thousands of dollars.

Related Post: {Debt Management} How to Shorten the Length of Your Loans & Reduce Interest

Heavy Chains of Habit- Good or Bad?

Chains of habit are too light until they are too heavy to be broken. Think about it like this, if you are in the habit of putting money aside every week, at the end of the year the weight of your weekly sacrifice would be greater than if you only saved for one week and then gave up. Every week, saving $10.00 here, $70.00 there, $100.00 every once in a while might not seem like a big deal at the time, but every penny adds up. Every time you save makes the habit of saving that much stronger. The same can be said for bad habits. Spending $10.00 here and $70.00 there may not seem like a big deal in the moment. But over time, that random spending becomes a bad habit and the weight of your debt becomes a heavy burden to carry.

YTD 52 Week BINGO Challenge

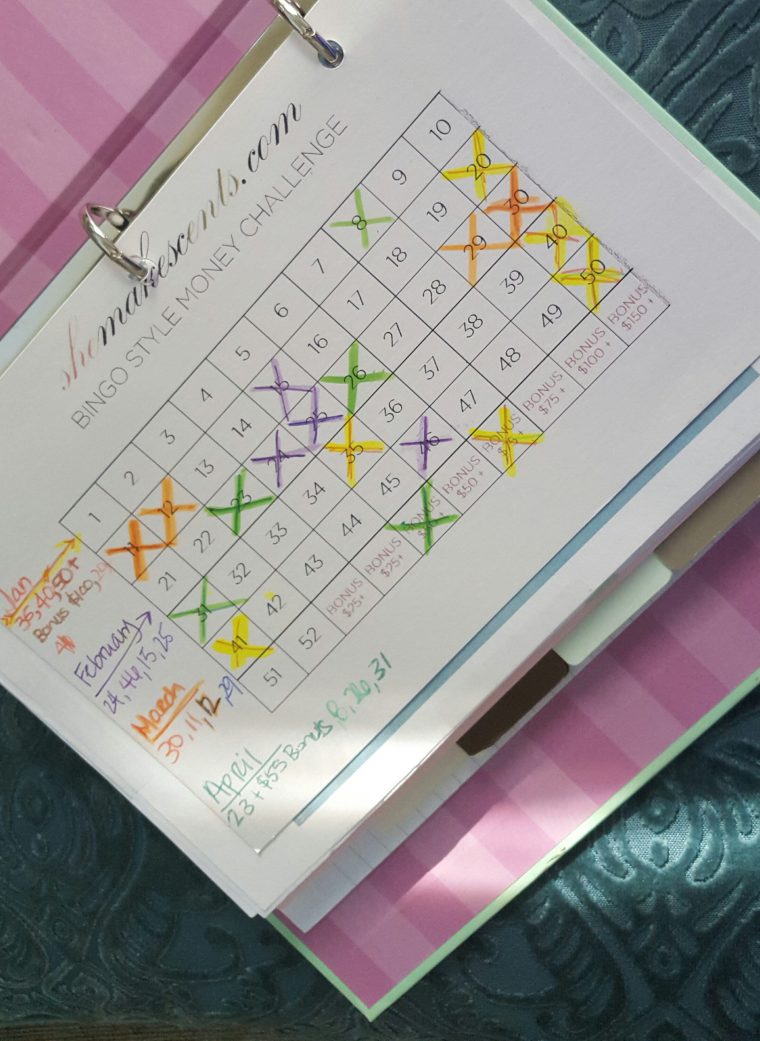

Doing the original 52 Week Challenge would result in $1378.00 for the entire year. Doing the #shemakescents BINGO version has me at $1395.00 YTD with another 19 weeks to go for the rest of the year.

Hey lovelies! I wanted to do a quick check-in this morning to see how you are doing on the 52 Week BINGO Money Challenge. I am well on my way with 23 boxes checked off (not including 3 bonus boxes) and step one of my snowball goal almost at the under $1,000.00 mark! Here is how the numbers are breaking down between January 2016- and May 2016.

Hey lovelies! I wanted to do a quick check-in this morning to see how you are doing on the 52 Week BINGO Money Challenge. I am well on my way with 23 boxes checked off (not including 3 bonus boxes) and step one of my snowball goal almost at the under $1,000.00 mark! Here is how the numbers are breaking down between January 2016- and May 2016.

The journey towards financial freedom isn’t a easy one…if it was, no one would have debt and everyone would be building wealth. Alysa’s biggest financial goal is to get her emergency fund to a healthy level so she can put more savings towards fun things. I’d say with a savings of $515.00 year to date, she is well on her way.

The journey towards financial freedom isn’t a easy one…if it was, no one would have debt and everyone would be building wealth. Alysa’s biggest financial goal is to get her emergency fund to a healthy level so she can put more savings towards fun things. I’d say with a savings of $515.00 year to date, she is well on her way.

For the first week of April, I decided to cross off $23.00 + a bonus of $75.00. My first April contribution, including the bonus, is only $4.00 less than my entire last month’s savings. I’d say I am off to a good start for month. Overall, I have a saved a total of $556.00 that I have been using to make extra payments toward my credit card debt. Every extra payment is helping me shave off the repayment term,

For the first week of April, I decided to cross off $23.00 + a bonus of $75.00. My first April contribution, including the bonus, is only $4.00 less than my entire last month’s savings. I’d say I am off to a good start for month. Overall, I have a saved a total of $556.00 that I have been using to make extra payments toward my credit card debt. Every extra payment is helping me shave off the repayment term,